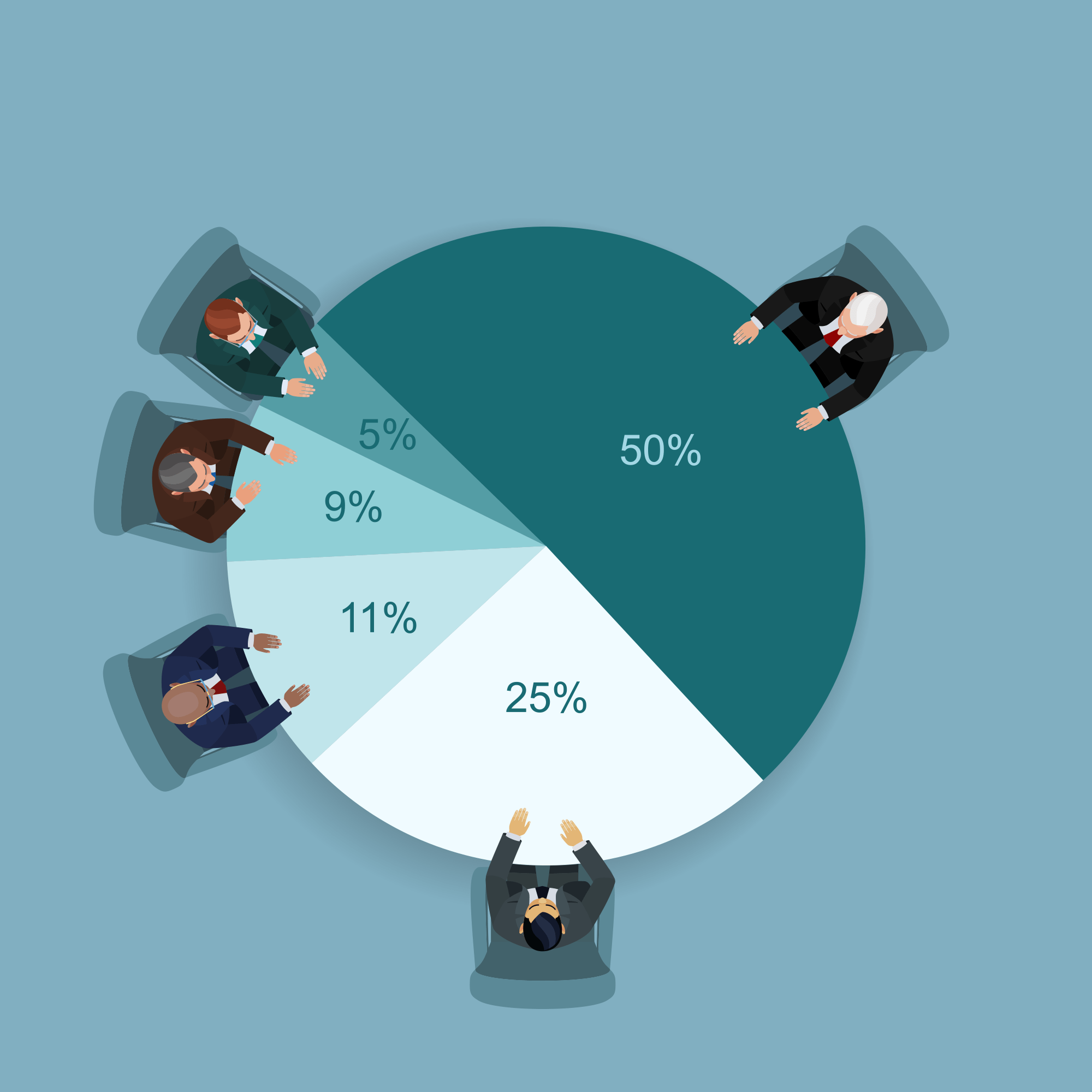

The year is 2020; the COVID19 pandemic has hit; uncertainty has plagued even the most stable of businesses. As a business owner and/or a Shareholder of a Company, we don’t have to tell you just how uncertain managing a business can be, nor do we have to remind you of how oftentimes, the individual minds of Shareholders rarely operate as one.

However, if you are one of the lucky ones and thought ahead, but now find yourself in a combative state with your fellow Shareholders – fear not! Your Shareholders’ Agreement will likely provide the steps you need to take in the event of a dispute. If this is your situation – call one of our Streeterlaw Commercial Litigation Solicitors today so that we may review and interpret your Shareholders Agreement and help you find the best ‘way out’ of the dispute you are currently facing.

If you do not have a Shareholders’ Agreement, there are a few options available to you that Streeterlaw Commercial Litigation Solicitors are more than equipped to navigate with you:

Negotiate a way-out

At Streeterlaw, we put your best interests first. Being client-focussed, our attention is drawn firstly to understanding your unique circumstances and interpreting the law in a way that benefits you the most. We are skilled negotiators and will try our best to communicate with the other Shareholders (usually via their Solicitors) to come to an agreed outcome that all parties (but especially you) can live with. Some of the outcomes we can negotiate, depending on your instructions are:

- Negotiating between the Shareholders to sell the business to an independent third party.

- Negotiating to split the business and sell only part of it.

- Negotiating the sale of shares.

- Negotiating for one or more Shareholders to sell their shares back to the Company (this triggers section 257 of the Corporations Act 2001 (Cth)), noting there are certain rules that need to be followed with this option).

Also, please remember, (and we empathise with how frustrated you are at this time) you can’t force the other Shareholder/s to sell their shares – it is important that you realise this at the outset. You cannot force-out your fellow Shareholder/s. However, there are certain orders the Court can make depending on the facts that can be proven (more on this below).

Commence Court Proceedings

If we have first tried to negotiate with the Shareholder/s but this has proven unproductive due to their mindset, it will be open to you to commence proceedings in Court.

- The jurisdiction is equally the Federal Court of Australia and the Supreme Court of New South Wales. Depending on your unique circumstances Streeterlaw will recommend one Court over the other.

- The causes of action (the legal grounds upon which you are suing the Shareholder/s) will largely depend upon your set of circumstances – but can include:

- Oppressive Conduct (section 232 of the Corporations Act) – for example, this can occur when majority shareholders use their influence in the Company for their own benefit, rather than the benefit of the Company as a whole. This conduct is against the law and can have a negative effect on the Share value of the Company. We can apply to the Court under s233 of the Corporations Act for various remedies, some of which include that one or more of the majority shareholders purchase the minority shareholder’s shares at a price determined by the Court or even that an injunction be granted against the Company or a Director/ Majority Shareholder to restrain a specific act.

- Application to Wind Up the Company – under s461 of the Corporations Act, we can apply to the Court to make an order that the Company be liquidated for a number of reasons. One such reason can be when the Court forms a view that it is ‘just and equitable’ to do so. The Court will need to consider whether in all the circumstances the deadlock / dispute between the Shareholders is so serious and severe that there is no possible way of it being resolved other than to bring an end to the Company’s existence.

Bringing a Statutory Derivative Action

This is like commencing proceedings but instead of commencing on your own behalf as an aggrieved office-holder / Shareholder of the Company, you are commencing the proceedings on behalf of the Company because the Company itself has been wronged in some way. There are a few legal grounds you need to satisfy in order to be eligible to commence proceedings in this way however it would be our pleasure to explore these options with you and guide you through them.

In today’s uncertain times for our business owners, we want to remind you that Streeterlaw is here to help you navigate your way through troubled waters. Shareholders’ disputes are costly, time-consuming and inefficient to the overall running of your business. Having a well-drafted Shareholders’ Agreement at the outset can alleviate future problems by importantly prescribing a specific dispute resolution process to be followed. If you do not have a Shareholders’ Agreement and find yourself in the midst of a messy dispute, call Streeterlaw today and work closely with our highly motivated team.