In December 2012, the Australian Government made changes to the laws relating to unclaimed money, including Section 69 of the Banking Act. Some of the elements of the changes are:

In December 2012, the Australian Government made changes to the laws relating to unclaimed money, including Section 69 of the Banking Act. Some of the elements of the changes are:

- The time at which money is recognised under the Banking Act as lost or unclaimed has been reduced from 7 years to 3 years.

- Amounts greater than $500 held by authorised deposit-taking institutions are affected.

- Account entries relating to fees, charges and interest are ignored.

- Institutions must provide annual unclaimed money returns to the Australian Securities and Investments Commission (“ASIC”) and ASIC can then request these monies be paid to it.

- ASIC will hold any such monies on behalf of the account owner and the Government will pay interest on the funds.

- The onus will be on the account owner to prove title in order to reclaim the money.

A deposit or withdrawal of as little as $1 every three years will avoid an account being deemed as unclaimed.

Many types of accounts will be impacted by the changes.

Accounts held on behalf of children and those held by people living overseas, along with trust accounts and accounts for lease bonds are some of the most common accounts held by ASIC.

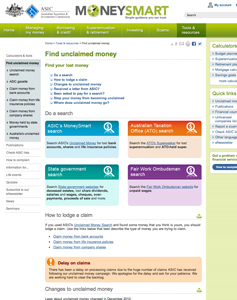

One advantage of the new legislation is that once the monies are with ASIC, it is much easier to search for them than if they were held privately by a bank or super fund.

To search for any unclaimed Australian funds you may own, you can search online by going to: https://www.moneysmart.gov.au/tools-and-resources/find-unclaimed-money